Financial Clarity & Strategic Growth

Beyond the Balance Sheet

Auditing Accounting & Strategy Acceleration Consulting LLP

Auditing, Accounting & Strategy Acceleration Analysis for Executive Leaders, Owners & Senior Managers who demand … both accuracy and vision.

Auditing, Accounting & Strategy Acceleration Analysis for Executive Leaders, Owners & Senior Managers who demand …both accuracy and vision.

The Foundation

Reliable financial data is the bedrock of any successful organization. Before we accelerate, we ensure your financial health is solid.

Auditing Services

Independent verification to ensure accuracy, compliance, and stakeholder confidence. We provide the rigor needed for external trust.

- Financial Statement Audits

- Compliance Reviews

- Internal Control Assessments

Accounting & Tax

Precision record-keeping and tax planning to minimize liability and maximize cash flow. Turning chaotic data into structured insight.

- Tax Planning & Preparation

- Cash Flow Management

- Virtual CFO Services

Core Consulting Service

Strategy Acceleration

We don’t just write plans; we audit the execution. Our goal is to close the gap between “Strategic Vision” and “Actual Achievement.”

Our Methodology

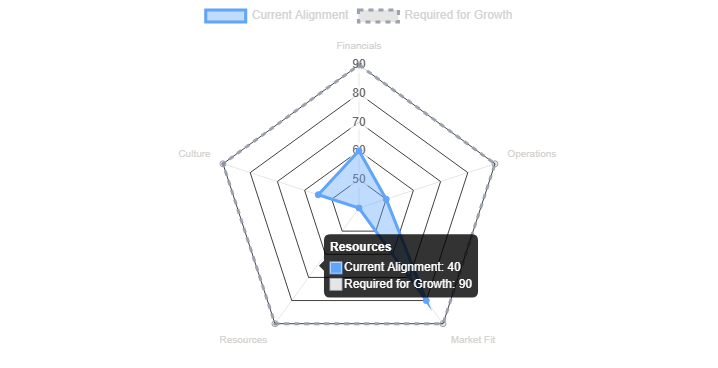

Step 1: Strategic Alignment

We help you build a robust strategic plan or audit your existing one to ensure it is viable, measurable, and aligned with your financial reality.

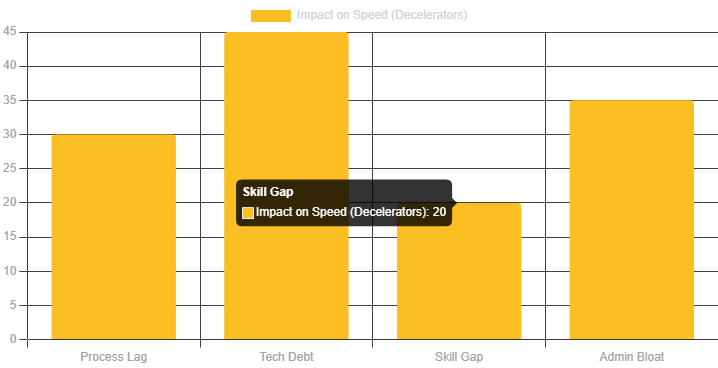

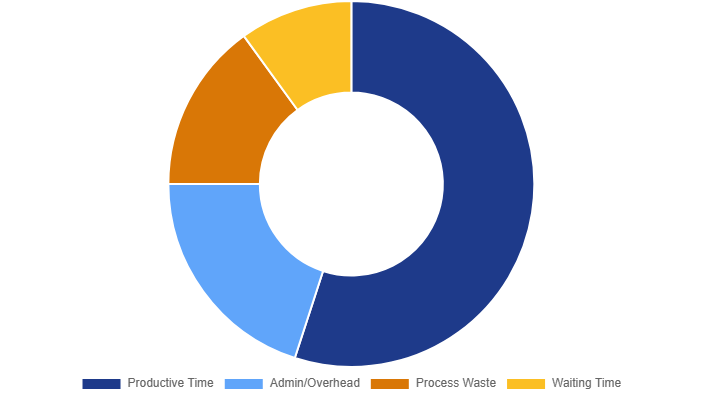

Step 2: Identify Decelerators

We analyze operations to identify ‘Decelerators’—friction points, bottlenecks, and resource gaps slowing you down.

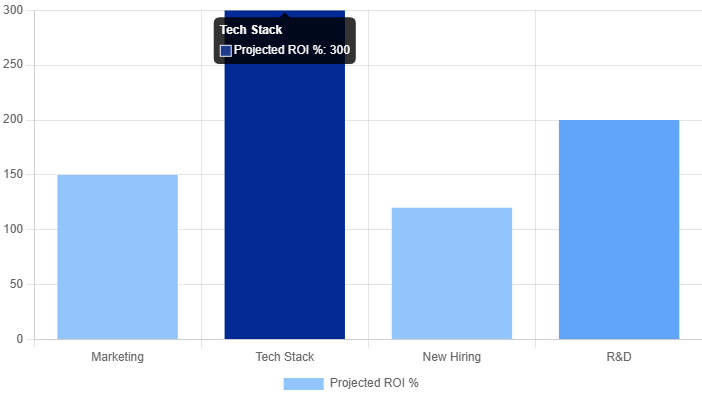

Step 3: Accelerator Roadmap

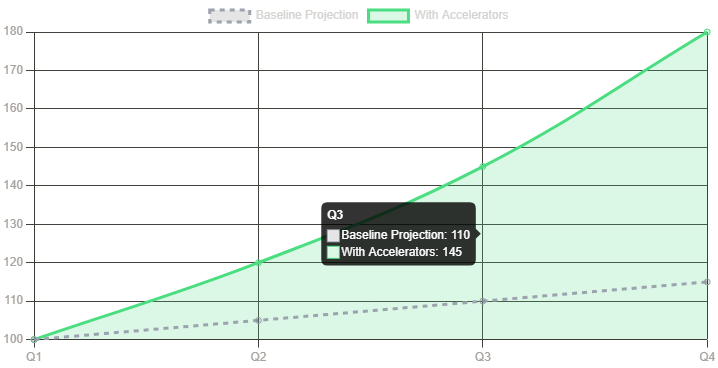

We prescribe specific ‘Accelerators’ to remove barriers. The chart shows the projected velocity increase after intervention.

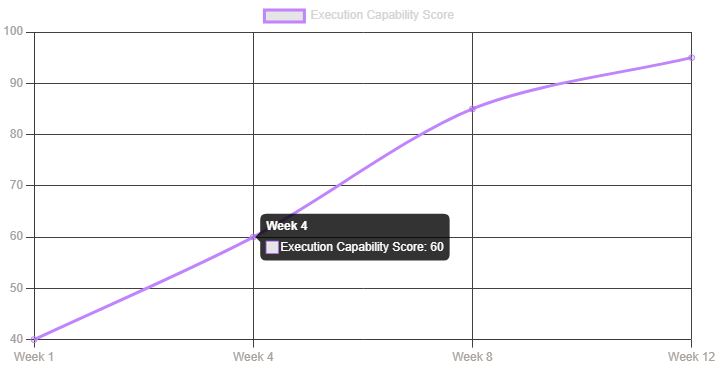

Step 4: Training & Coaching

We train leadership on execution and self-auditing frameworks. Ensuring the acceleration is sustainable.

Analytical Support

Turn Data into Direction

As Strategic Business Analysts, we provide the quantitative backing for your qualitative decisions. Explore our core analysis types below.

Analysis Modules

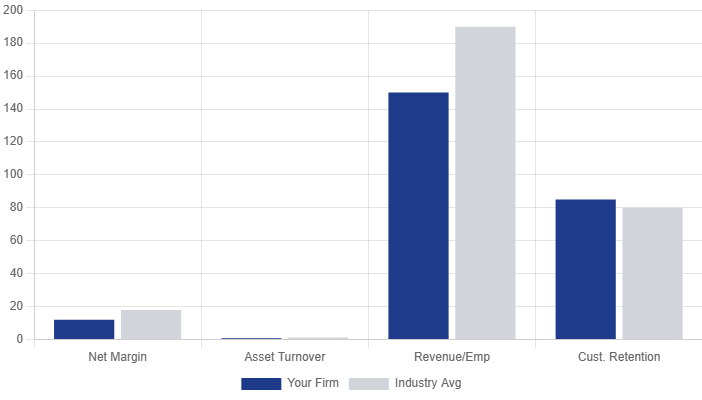

Industry Performance Gap:

How do you measure up against industry leaders? We analyze key performance indicators (KPIs) to identify gaps.

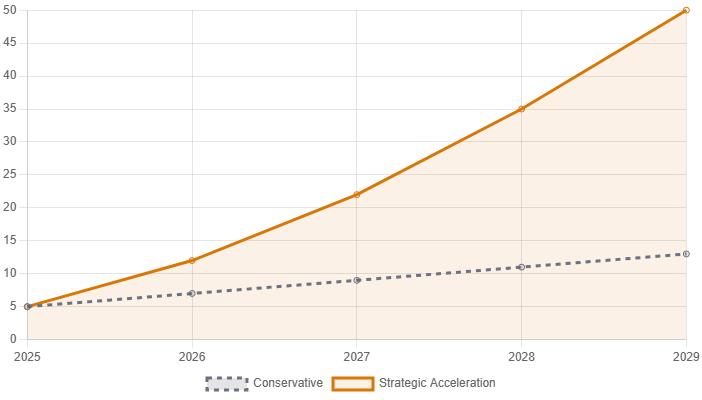

Scenario Planning: Growth Models:

Scenario planning and financial modeling to stress-test your growth strategies before you execute.

Process Efficiency Analysis:

Identifying bottlenecks in your business processes that are leaking profit.

Investment ROI Projection:

Rigorous evaluation of potential investments ensuring capital is deployed for highest returns.

Why Integrate Accounting with Strategy?

The Traditional Silo

Accountants look backward. Consultants look forward. This disconnect leads to strategies that are financially unfeasible.

The Walter Murray Integration

Auditing Standards with we combine Strategic Acceleration Your big-picture strategy is always grounded in financial reality

Ready to Accelerate?

Schedule a consultation to identify your decelerators and map your path to growth.